The number of online income tax return filings has crossed six lakhs amidst growing interest and voluntary participation among taxpayers to comply with the rules and avoid the hassles of visiting tax offices. At the same time, the number of registration for online income tax return filing crossed 13 lakh using the e-return option of www.etaxnbr.gov.bd portal with voluntary participation, according to a National Board of Revenue (NBR) press release on Sunday (Dec 1).

The revenue board has urged all taxpayers to file return online for smooth return filing and availing hassle-free services.

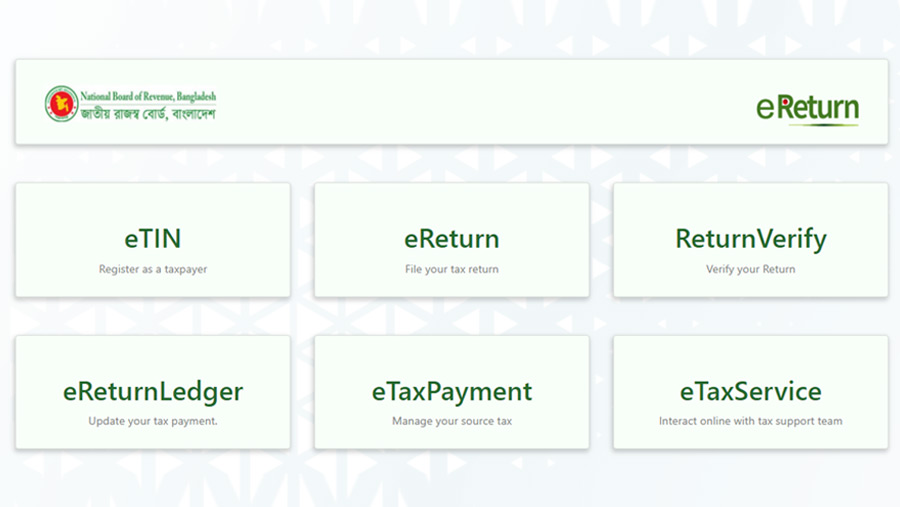

In order to facilitate the filing and payment of income tax returns for the tax year 2024-2025, it has already opened online return filing system for taxpayers.

Individual taxpayers can easily and quickly prepare and file their returns online using the NBR website.

From this system, taxpayers can pay taxes through internet banking, card payment (debit/credit card), mobile banking and get the facility of downloading and printing copies of filed returns, receipts, income tax certificates, TIN certificates as well as availing adjustment of tax refund.

Anyone can also download and print the e-Return filed for the previous year.

The NBR has also set up a call centre to assist taxpayers with any issues related to e-Return.

Taxpayers are getting immediate telephonic solution of e-Return queries by calling the call centre on 09643 7171 71 during office hours.

Besides, taxpayers can report any problem related to e-Return through e-mail from the e-Tax Service option of www.etaxnbr.gov.bd which is being resolved at the earliest.

Already the e-Return registration process has become more taxpayer friendly.

In order to make the e-Return system more taxpayer-friendly, several changes have already been made to the www.etaxnbr.gov.bd portal, including the up gradation of the registration system.